Log in

After you launch Trade Interceptor on your device, login in "Traders Gym".

You can log in with the same username and password as in Demo or Live mode.

Register a paper trading account

After logging in, you will see a charting screens and the accounts panel. Tap on the "+" symbol in the accounts panel (1 on the screenshot) and set the account name, deposit amount, the account's currency and the leverage that you will use.

After filling in these details, tap on "Create". Then select "Done".

Set the instrument and the time interval for which you want to simulate a trade

The next step is to select the instrument that you want to trade and a time interval for which you want to perform a trade.

First tap on "Chart" from the lower menu bar.

Then on the "+" symbol in the top right corner of the chart.

Apply the desired setting in the "Create chart" window – choose the price feed, instrument, price type and time frame.

Then you can set the time interval for the simulated trade and the date on which to place a trade.

After applying these settings, tap on "Done".

Start the simulation

When you are ready with the above settings, tap on "Trading" in the upper chart menu.

Choose the trading amount, the type of order, set Stop Loss or Take profit levels.

Then tap on "Buy" or "Sell"

The next step is to go back to "Chart" in the upper chart menu.

Tap on the start button of the market Player below the chart.

You can play the simulation automatically, pause it, or forward/rewind candle by candle.

When the testing period finishes, you will see notification "Simulation over. End of data reached".

Control the simulation speed

You can control the simulation speed by tabbing on the arrow on the right of the player. Then form the bar you will be able to control the speed.

Control each candle's movements

You can control the movements within each candle using the time frame button below the chart.

For example, if you are simulating trading on 1H time frame, and you set 1 min from the time frame button below the chart, you will see how the candle moves 60 times before completion.

If you are simulating trading on 1H time frame, and you set 15 min from the drop down menu, you will see how the candle forms in 4 steps before completion.

How to see a position on the chart

Go to "Portfolio", tap on "Trades", tap on a trade and select "Chart". Then tap on "Chart" from the lower menu bar.

Modify an order

Go to "Portfolio", tap on "Trades", tap on a trade and select "Modify order".

Close an order

Go to "Trades" from the accounts panel (7 on the screenshot), tap on a trade and select "Close order".

Alternatively, go to "Chart" from the lower menu bar, tap on "Position", tap on your position from the chart and select "Close trade".

Run a report

You can generate a summary of all your trades when you go to "Portfolio" and tap on:

- "History" from the accounts panel

- Accounts info

Delete a position

Go to the "Portfolio", select "Accounts", select "Trades" or "History", tap on a trade and select "Delete"

Simulate deposit/withdraw

To simulate a deposit or withdrawal, go to "Portfolio", select "Accounts" tap on "Edit" and select "Options".

Add new paper account

Tap on "Portfolio" and then on the "+" sign in the accounts panel. Set account name, deposit amount, the account's currency and the leverage that you will use.

Delete a paper account

Go to "Portfolio", select "Accounts" tap on "Edit" and select "Delete".

How to browse charts

Go to "Charts" and tap on the button in the lower right corner of the chart.

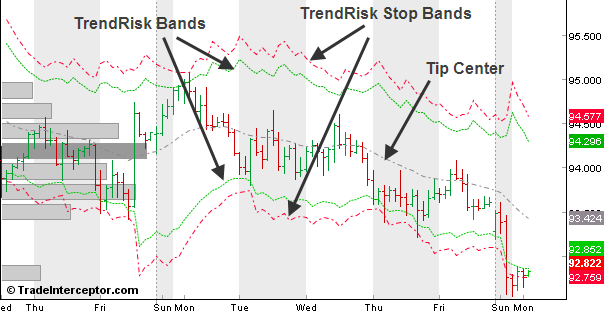

Chart types, tools, indicators

Please read section "Chart Features" of the Help Manual